NGPF Featured Activity: ANALYZE: Categorizing Credit

The following post is courtesy of Lois Stoll, Benjamin Logan High School (Bellfontaine, OH). In this post, she discussed how she incorporated manipulatives into the ANALYZE: Categorizing Credit lesson!

Directions for adding manipulatives to the ANALYZE: Categorizing Credit lesson.

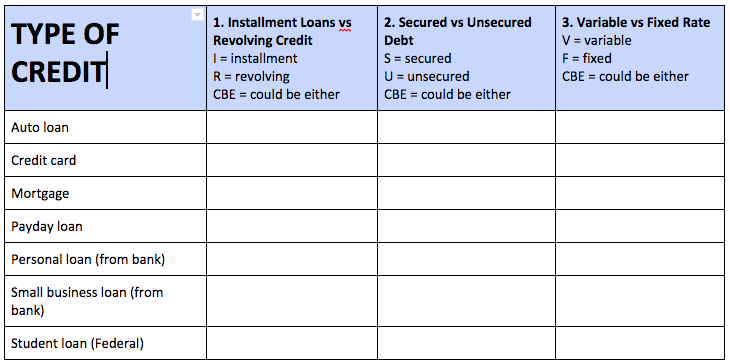

To make this lesson more interactive, print labels and make cards for each group of students. The Yellow cards represent the different categories of credit:

- I = Installment

- S = Secured

- V = Variable

- R = Revolving

- U = Unsecured

- F = Fixed

- CBE = Could be either

- They will discuss as a group and hold up a card to indicate their answer as you review the chart.

To make the cards: I printed labels on white shipping labels (2” x 4” Avery 5963). I then adhered them to six different colors of cardstock which I cut to a 4 ¼” x 3 ⅝” size. These could be laminated to save for future use, I used them for 3 classes and they held up great.

To run the activity:

- Distribute one set of cards per group.

- Give students a copy of the Analyze: Categorizing Credit activity.

- Review the front of the activity worksheet giving examples for I vs.R, S vs. U, V vs. F and of course CBE.

- Do one row of the chart at a time. Have them discuss what they think their three cards should be and then call out each block (eg. What do you think auto loan is I or R?). Check for answers around the room, then reinforce correct answer. Here's a copy of the chart from the activity:

Optional: Keep score to see how many the group gets right. Small prizes could be awarded eg. smarties. When chart is finished, students should answer the rest of the questions on their own.

How did it work for me?

The students loved this part of the assignment. They are highly competitive and like to “beat” their peers at any game. I liked that we did it row by row and block by block so I could reinforce the concepts. Some groups tried to hedge their bets by watching what cards others held up but it was not a big problem. You could have all cards go up simultaneously.

Thank you Lois!

About the Author

Laura Matchett

After graduating with an education degree and spending 7 years in an elementary classroom, Laura made the switch to the non-profit world and loves interacting with students, educators and business professionals across the country. She is passionate about all students having access to high quality education and views personal finance education as one way to ‘level the playing field’. When Laura is not locating or creating high quality educational resources, you can find her mountain biking or searching for the best ramen in town!

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS