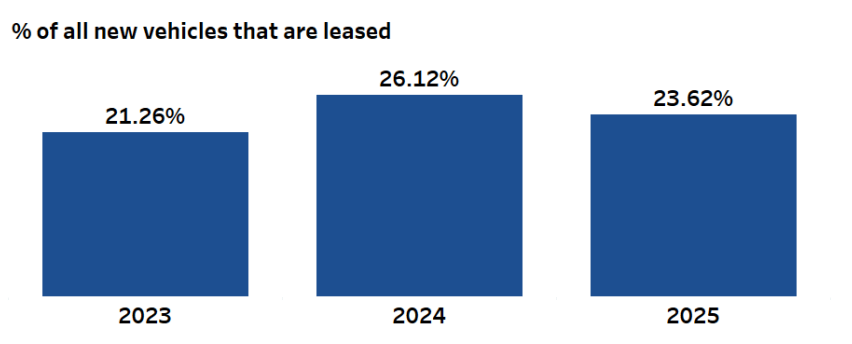

Question of the Day: What percentage of new vehicle transactions involve leasing instead of buying?

Is leasing steering the trend for new cars, or is purchasing still in the fast lane?

Answer: 24%. That's almost 1 in 4!

Questions:

- What is the difference between buying a new car and leasing one?

- Why do you think many people rely on leasing?

- Do you think a leased car is a good financial decision? Why or why not?

Click here for the ready-to-go slides for this Question of the Day you can use in your classroom.

Behind the numbers (Experian article and data):

"Drivers who choose to lease their car instead of buying it outright are a minority in the U.S. Only about 20% of consumers with an Experian credit file have an auto lease in 2025. Meanwhile, most consumers (61%) have at least one auto loan tradeline in their credit file.

Leasing is competitive with car ownership on price—as we'll show—but what motivates lessees depends on the individual. Positive factors include greater convenience, lower taxes and less upkeep. There are some big downsides, however, including limitations on mileage and the expectation that the vehicle is returned to the lessor at the end of the lease term.

According to Experian data from June 2025, the average auto lease payment was $659—slightly lower than the average monthly auto loan payment of $682."

---------------------

Want to learn more about the process of Buying a Car? Check out the Buying a Car mini-unit.

---------------------

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS