Question of the Day: What percent of adults have carried credit card debt in the past year?

The burden of credit card debt is heavy. How many adults carried this extra weight last year?

Answer: 37%

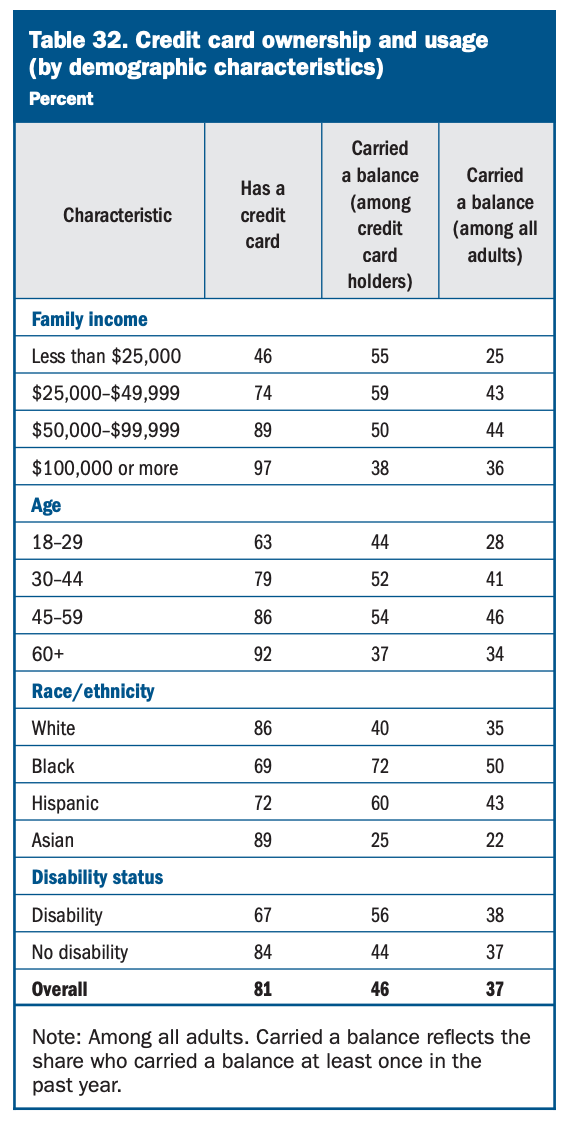

37% of all adults carried a balance. That number jumps to 46% for adults who have a credit card.

Questions:

- What does it mean to “carry” credit card debt?

- Credit card companies list a minimum payment due on your monthly statement. What happens if you only make the minimum payment?

- Even though it’s expensive to carry credit card debt, why might some consumers not pay their credit card bill in full every month?

- What are some strategies to help you avoid carrying credit card debt?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Federal Reserve Board):

"While credit card ownership has increased over the past decade, carrying a credit card balance has become less prevalent. In 2024, 46 percent of credit card owners said they carried a balance at least once during the prior 12 months, down 11 percentage points since 2015 (figure 28).

----------------

Our Video Library includes this great video to learn more: Credit Card Debt Explained

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS