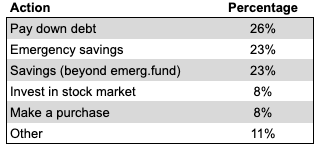

Question of the Day: We asked 300+ personal finance teachers what they planned to do with their stimulus check. What was their #1 answer?

Answer: Pay down debt

Here's a summary of their responses:

Questions:

- How do you think YOU would handle a lump sum payment of several hundred dollars NOW?

- Why do you think people answer this question with such different responses?

- What is the importance of having an emergency savings fund now?

Behind the numbers (USA Today)

Millions of workers and their families will receive a one-time check from the government as part of the coronavirus stimulus package. Most adults will get $1,200, while children will receive another $500.

For workers who have already lost their jobs because of the pandemic’s hit to the economy, that extra money will likely be immediately put to good use — paying rent, mortgages, utility bills and more. But if you have a paycheck, what’s the best use of that money? Should you save it, pay down debt or spend it to help keep your local economy working?

-------------------

This EdPuzzle video, Your Stimulus Package, also addresses this importance of having a plan and emergency funds.

--------------------

Want to think about strategies to bring current events to your students? Be sure to attend the Virtual PD later today (Monday) focused on Current Events with Kareem.

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS