Curriculum Insider: Deep Dive into Middle School Unit 2

One of the most popular units in the NGPF Middle School Course is Unit 2: Consumer Skills. In this unit, students learn about the following 5 topics:

- Comparison Shopping

- Coupons and Discounts

- How to Read a Receipt

- Checking Accounts

- Different Types of Payments

Below, we'll deep dive into each lesson and highlight a specific resource that we think is especially engaging, informative, and fun to use with your students!

Lesson 2.1 Comparison Shopping

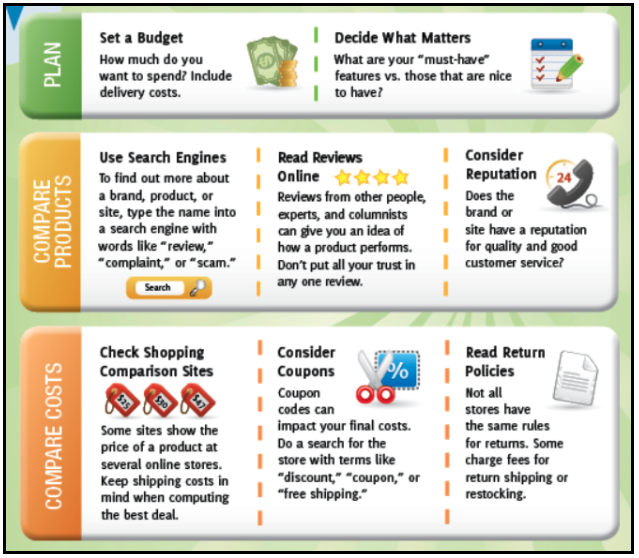

With the rise of online shopping, comparison shopping is more prevalent now than ever before. We can compare prices, read reviews, ask questions about product quality, get deals, and more...all from our smartphones and computers. In this lesson, students read through the following infographic from the Federal Trade Commission to learn how to comparison shop effectively before answering comprehension questions.

Lesson 2.2 Coupons and Discounts

We all love a good deal for our favorite stores and products. But how exactly do companies market these deals to get us to buy more...and more...and more? Students dive into the science behind discounts, promotions, and free offers by reading the following article and answering comprehension questions. BONUS: They then apply what they've learned and practice their MATH skills through the activity in the DO IT portion of the lesson!

Lesson 2.3 How to Read a Receipt

We all know that when you purchase something, the record of the transaction is laid out in a receipt. But how well can we read all of the intricate details that are recorded in this document? After learning about the various components that make up a receipt, students put their fine print reading skills to the test by reading real-life, sample receipts and answering questions in the activity, FINE PRINT: Read a Receipt!

|

|

Lesson 2.4 Checking Accounts

Checking accounts are often one of the first financial products students will use. Knowing how to open a checking account and how to actively maintain it, however, can require some research (and practice)! Students can rest assured that they'll learn everything they need to know about opening a checking in the following EdPuzzle.

If you're unfamiliar with EdPuzzle, it's a fun video platform that allows you to embed questions, notes, and more directly into the video to gauge student comprehension! Don't want to use EdPuzzle? No problem - just click on the YouTube icon on the bottom, right-hand corner to watch the original video!

Lesson 2.5 Different Types of Payment

In this final lesson, students learn about various types of payment options available to them including prepaid cards, gift cards, peer-to-peer payment apps, and mobile wallets. They compare when it is appropriate to use each payment type, how to use it, and where the money comes from. Then, they put all that knowledge to the test in the activity, PLAY: Which Payment Type Should They Use? This activity can be done individually, in groups, or as a whole class!

|

|

As you can see, Unit 2 of the Middle School Course (and every unit!) is filled with a rich variety of resources that is bound to engage your students in a fun and interactive way as they learn foundational personal finance content and skills. We hope you enjoy using the course with your students!

If you want to learn more about the Middle School Course, collaborate with other educators, and earn NGPF Academy credit, sign up for one of our Middle School Virtual PDs!

About the Authors

Sonia Dalal

Sonia has always been passionate about instruction and improving students' learning experiences. She's come a long way since her days as a first grader, when she would "teach" music and read to her very attentive stuffed animals after school. Since then, she has taught students as a K-12 tutor, worked in several EdTech startups in the Bay Area, and completed her Ed.M in Education from the Harvard Graduate School of Education. She is passionate about bringing the high quality personal finance content and instruction she wished she'd received in school to the next generation of students and educators. When she isn't crafting lesson guides or working with teachers, Sonia loves to spend her time singing, being outdoors, and adventuring with family and friends!

Christian Sherrill

Former teacher, forever financial education nerd. As NGPF's Director of Teacher Success, Christian is laser-focused on helping the heroic teachers who fuel NGPF's mission to guarantee all students a life-changing personal finance course. Having paid down over $40k in student loans in the span of 3 years - while living in the Bay Area on an entry level teacher's salary - he's eager to help the next generation avoid financial pitfalls one semester at a time.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS