Question of the Day: How much cheaper are autonomous robo-taxis to operate compared to private cars (in dollars saved annually)?

Answer: $5,000

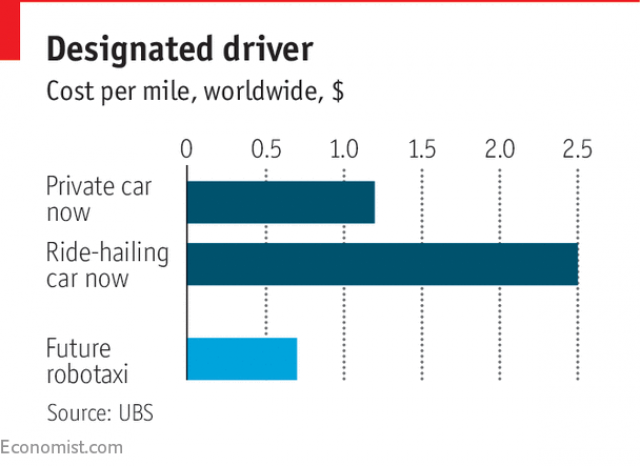

Cost for private car today = $1.20 per mile

Cost for future robo-taxi = $0.70 per mile

Typical family drives 10,000 miles X $0.50/mile cost savings = $5,000

Questions:

- What are the costs you/your family incurs to own a car today? Be sure to create as complete a list as possible.

- What are the factors that lead to such a large cost savings using a robo-taxi (in future) instead of owning your own private car?

- What are the costs that disappear or are greatly reduced if there is a shift to a robo-taxi?

- Do you think your generation will choose not to buy cars given this trend toward ride-hailing and robo-taxis? Explain.

- List careers that you think could be impacted by autonomous vehicles.

Here's the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (from Economist):

The combination of autonomy and ride-hailing, together with a switch to electric vehicles, seems likely to undermine the logic of car ownership for many people. Ride-hailing services in the rich world currently cost around $2.50 per mile, compared with about $1.20 per mile to own and operate a private car (see chart). But the driver accounts for about 60% of the cost of ride-hailing. UBS, an investment bank, reckons that automation, competition and electrification (which makes cars more expensive to buy but much cheaper to run) will cut the cost of ride-hailing by 70%, to about $0.70 per mile. So a typical Western household driving 10,000 miles a year could ditch its car, use robotaxis and save $5,000 a year.

-----------------

How does it feel to drive for Uber? Try this simulation and find out (spoiler alert: it's hard work!)

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS